What are the Best Small Business Credit Cards for 2020?

As a business owner, you’re going to want to have a credit card to cover your expenses that are outside of your regular budget. Here are the best small business credit cards that are worth applying for.

As a small startup, your struggles are a lot different from those of larger companies. Things tend to be pretty expensive for you, and you need a way to level up without draining your bank account.

Thank goodness there are small business credit cards that can help pick up the slack. The problem is, which card works best for your business needs? Don’t worry – we’ve got you covered.

The Best Small Business Credit Cards for 2020

We’ve put together a list of the best cards that 2018 could offer. Read on to find out which one works best for you.

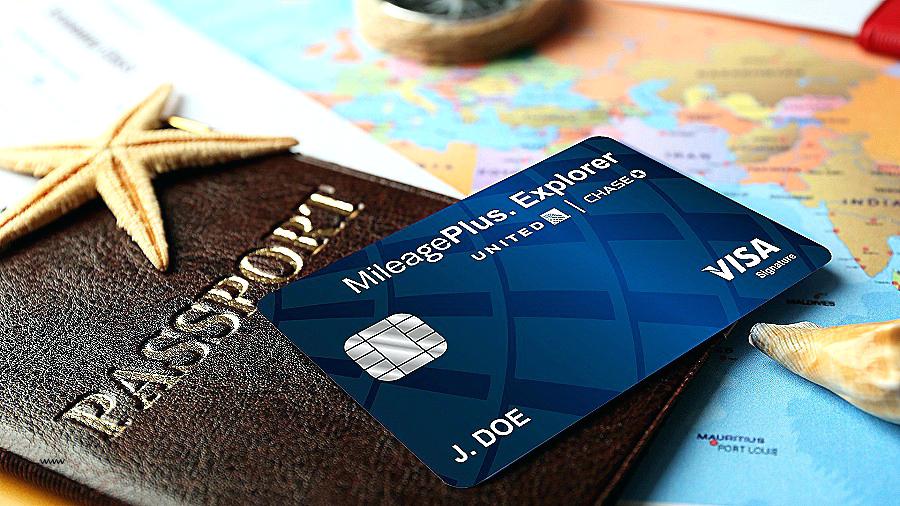

For the Best Cash Sign up Bonus: Chase Ink business card

If you’re all about racking up bonus points, you need to get your hands on this card.

The Chase Ink Business Card does not hold back on handing out rewards. For starters, if you spin $5,000 within three months, you’ll earn 80,000 in bonus points. That transfers into $1,000 in travel fares. Pretty sweet, huh?

For the Most Customizable Rewards: American Express Blue Business Cash

American Express Blue Business Cash – there’s nothing wrong with getting exactly what you want, and American Express gets it.

Just the basic specs are impressive enough. This card starts you off with a $0 annual fee as well as a $0 intro APR for a solid 15 months. Talk about some incredible perks.

But let’s talk about the real kicker. Unlike most companies who tell you which rotating categories you have to activate, SimplyCash Plus lets you choose whichever category you want and give you a 3% automatic cashback.

Oh yeah, and did we tell you the cashback was monthly?

For a Flat-rate Cash Back: Capital One Spark Cash

This little guy doesn’t play any games. The Capital One Spark Cash hits you with the 2% cashback straight out of the box. And this isn’t just on select items – the cashback award can be applied to every category, period.

Plus, as an added bonus, Capital One will give you $500 if you spend $4,500 or more within three months. Because who doesn’t want to have all the things?

For the Best Flat-rate Travel Rewards: Capital One Spark Miles

This list of business credit cards just keeps getting better.

If you’re one of those high-ranking business people who constantly find themselves on a plane for work affairs, this is definitely the card for you.

The Capital One Spark Miles for Business lets you rack up some serious travel rewards points – and fast.

To start you off, Capital One gives you 50,000 in miles whenever you spend $4,500 or more within three months of activation. Apparently, that wasn’t enough, so they decided to take things a step further.

For every dollar that you spend, you earn two miles in rewards points. This applies to every purchase, no matter the category, so limitations are a thing of the past.

The best part? The miles never expire, and there’s no limit to the categories you can buy from.

Rack up the points with this card, and pretty soon, you’ll know your flight attendant on a first name basis.

For 0% intro APR: American Express Blue Business Plus

Why do we love to go on business trips? Because hotels, that’s why. Amex gets this, and they’ve presented us with the Marriott Bonvoy Business Credit from American Express.

This piece of plastic will have you living like royalty in only the best 5-star hotels. When you activate your card you get a 75,000-point welcome bonus after you spend $3,000 on purchases within the first 3 months of account opening.

You also earn up to 6 points for Starwood stays up to 4 points for gas stations, restaurants and more, and 1 point for all other purchases.

As if it couldn’t get any better, you can also use your points to purchase flight seats for domestic and international travel. Basically, as long as you keep purchasing with this card, you’ll keep working in style. So, where to next?

American Express Blue Business Plus – this is hands down one of the best business credit cards for startups.

A high APR can crush a startup very fast, which is why most startups avoid the credit card in the first place.

The problem is, things can get very expensive, very fast. Most of the time, you just don’t have the budget to go it alone. So what do you do?

Well, for starters, you could just go with the American Express Blue Business Plus card.

This little guy packs a big punch when it comes to getting startups on the good foot. The moment you activate the Blue Business Plus card, it serves up a 0% intro APR on all purchases and balance transfers for 15 months.

That’s some serious firepower.

To give you a little extra, American Express gives you double the reward points when you make everyday business purchases up to $50,000 each year.

With a card like this, your startup will be leading the pack in no time flat.

For Those With Fair Credit: Capital One Spark Classic

As if Capital One hasn’t done enough, they’ve got startup business credit cards with no credit or low credit options.

We’ve all gotten a couple of dents in our credit score, but that shouldn’t be a reason for us to miss out on sweet deals, right?

Thankfully, the gurus at Capital One have answered our prayers. The Spark Classic is just a great card all around. You start off by enjoying no annual fee (such a great feature!), and you earn 1% cash back on every purchase you make.

“Sounds good,” you say, “but what about actually building my credit?” Relax, dude. We’ve got you covered.

The Spark Classic naturally helps you build business credit with continuous, responsible use.

It also gives you nice little perks such as year-end summaries (so you can see how responsible you’ve become) free cards for your employees and small business customer service.

How’s that for building up your credit?

For the Most Hotel Rewards Points: American Express Starwood Preferred Guest

Why do we love to go on business trips? Because hotels, that’s why. Amex gets this, and they’ve presented us with the Starwood Preferred Guest Business card. This piece of plastic will have you living like royalty in only the best 5-star hotels.

When you first activate your card, Starwood gives you 25,000 in Star Points. Since Reward Nights start at around 2,000 a night, that’s enough points for up to 12 free hotel nights (which is just insane).

You also earn up to 5 points for Starwood stays, up to 2 points for Mariott Rewards stays, and 1 point for all other purchases.

As if it couldn’t get any better, you can also use your Star Points to purchase flight seats for domestic and international travel. Basically, as long as you keep purchasing with this card, you’ll keep working in style.

So, where to next?

Card Tricks for Them, Too

Psst…want us to let you in on a little secret?

Sometimes, small businesses may have a hard time trying to authorize their customers’ credit cards because they haven’t built up a name for themselves.

Thankfully, there are people you can talk to that can help change that. Check out this website to learn more about how you can start making some online cash – fast.

Come Vibe With Us

Wanna you learn about some cool stuff? Why not check us out?

Sure we know a thing or two about small business credit cards, but we cover many more topics on startups, as well as news about travel, art, and a ton of other awesome categories.

Think there’s a subject we missed out on? Let us know, and you might see it on our site. We look forward to hearing from you.