The Best Small Business Retirement Plan For Your Business

Being a self-employed small business owner does not mean you have to forfeit a retirement savings plan.

Picking the right retirement plan for you and your financial goals are very important, and you must keep in mind a few factors like how much you can save into a retirement plan, if you have employees or not as well as when you plan to set up this retirement plan.

No matter which retirement plan you choose, it is recommended to save anywhere between 10 to 20 percent of your gross income every year. If you cannot save that much, it is best to save something.

Choosing the best small business retirement plan can be your key, ensuring you have enough in the bank for life after work. Here are the different types to choose from.

MyRA

This is a Roth IRA that invests in government bonds, meaning contributions are made with after-tax dollars.

The contribution limit is $5,000, and it is a no-hassle plan for employers because there is no cost to employers, they do not administer employee accounts, and they do not contribute to or match employee contributions.

The minimum deposit is $25 per employee, and you or your employees can contribute as low as $5 per pay period.

The money in this type of account earns a guaranteed return equal to that of the “G” fund in the government’s Thrift Savings Plan.

In addition, those saving in this type of plan can contribute up to $5,500 a year or $6,500 if they are 50 years or older. The money saved can be withdrawn at any time without taxes or penalties.

SEP IRAs

You may be wondering what is a SEP IRA.

Simplified Employee Pension plans, also known as SEPs, are made by the employer.

These are best for small businesses like sole proprietors, partnerships, and corporations because these allow you to put a lot of money away with minimal expense or paperwork since this type of account does not have to be filed with the government.

Contributions are only from your employer and cannot exceed $56,000 for 2019 and $57,000 for 2020 as well as 25 percent of the employees’ net compensation.

This option also allows employees to save in their own IRAs, and some small companies can be eligible for a $500 tax credit for three tax years to offset startup costs.

As far as withdrawals, loans, and payments for this type of account, you can withdraw at anytime subject to federal income taxes, and if you withdraw early, you may be subject to an additional tax.

You are not able to take loans out of these types of accounts.

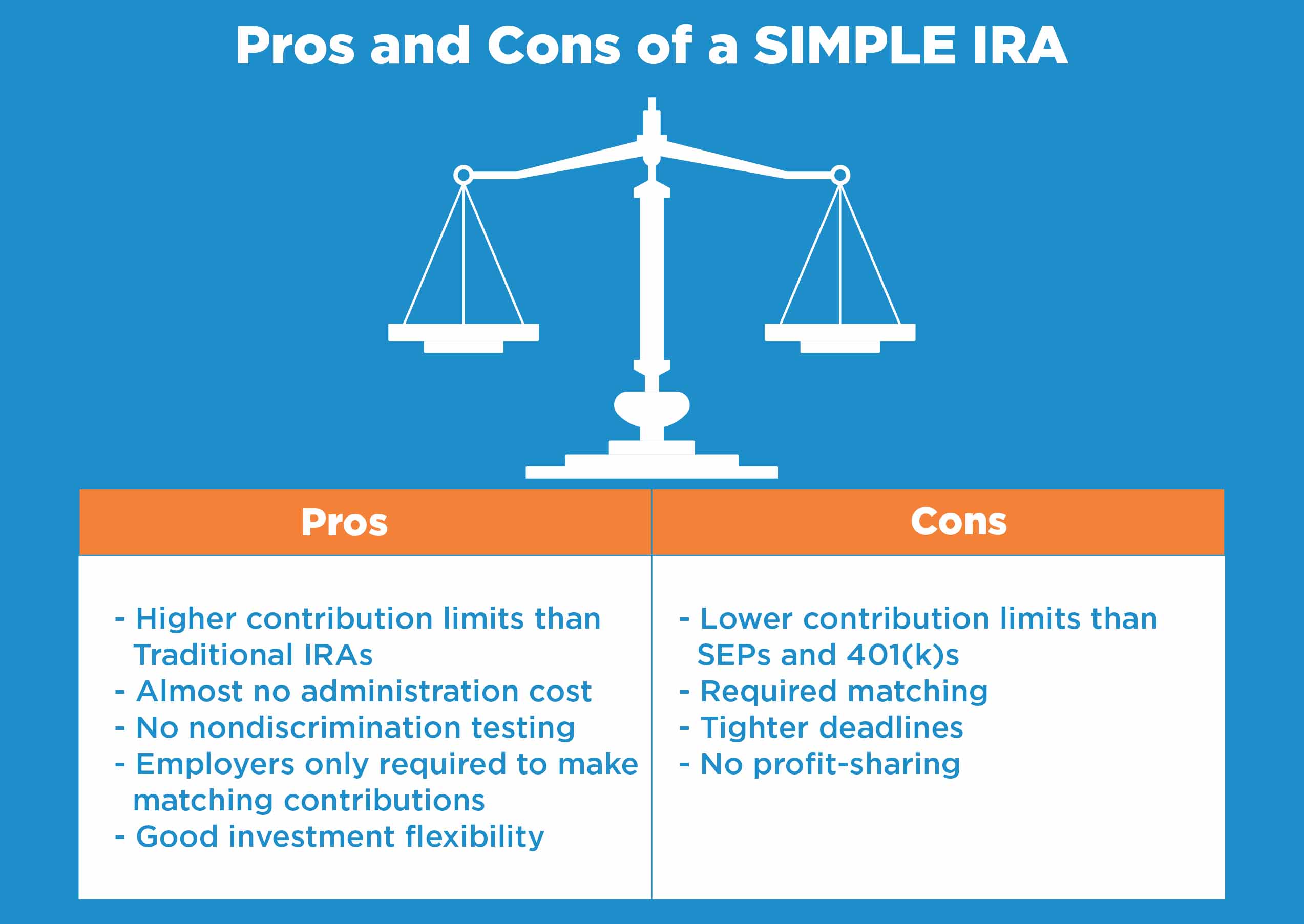

SIMPLE IRA

One of the key advantages of this type of plan is it is a salary reduction plan with little administrative paperwork.

Any employer with 100 or fewer employees is eligible for this plan. Since your bank or other financial institution handles most of the paperwork, the employer does not have to do any annual filing with the government.

There is both employer and employee contribution, but for an employee, they have to have a salary reduction contribution.

The maximum yearly contribution for an employee is $13,000 in 2019 and $13,500 in 2020.

Employees 50 years or older can make additional contributions of up to $3,000 in 2019 as well as 2020.

The maxim yearly contribution for an employer can either match an employee’s contributions 100 percent of the first three percent of compensation, or they can contribute two percent of each eligible employee’s compensation.

Withdrawals are allowed at anytime subject to federal income taxes, and early withdrawals can subject to an additional tax.

Like the SEP IRAs, taking a loan out of this plan is not possible.

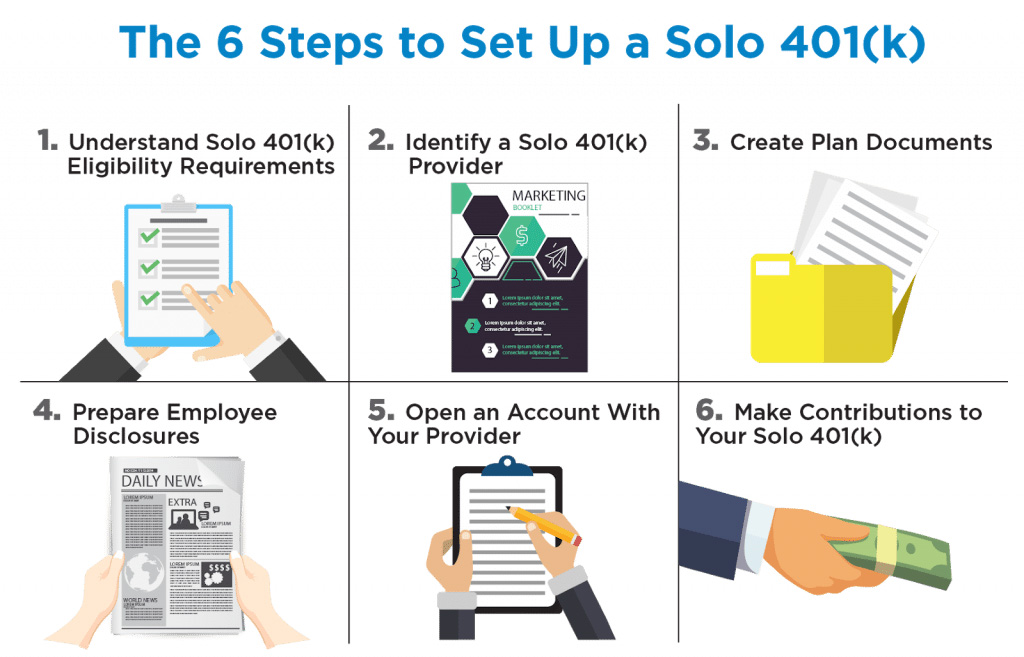

Solo 401(k)

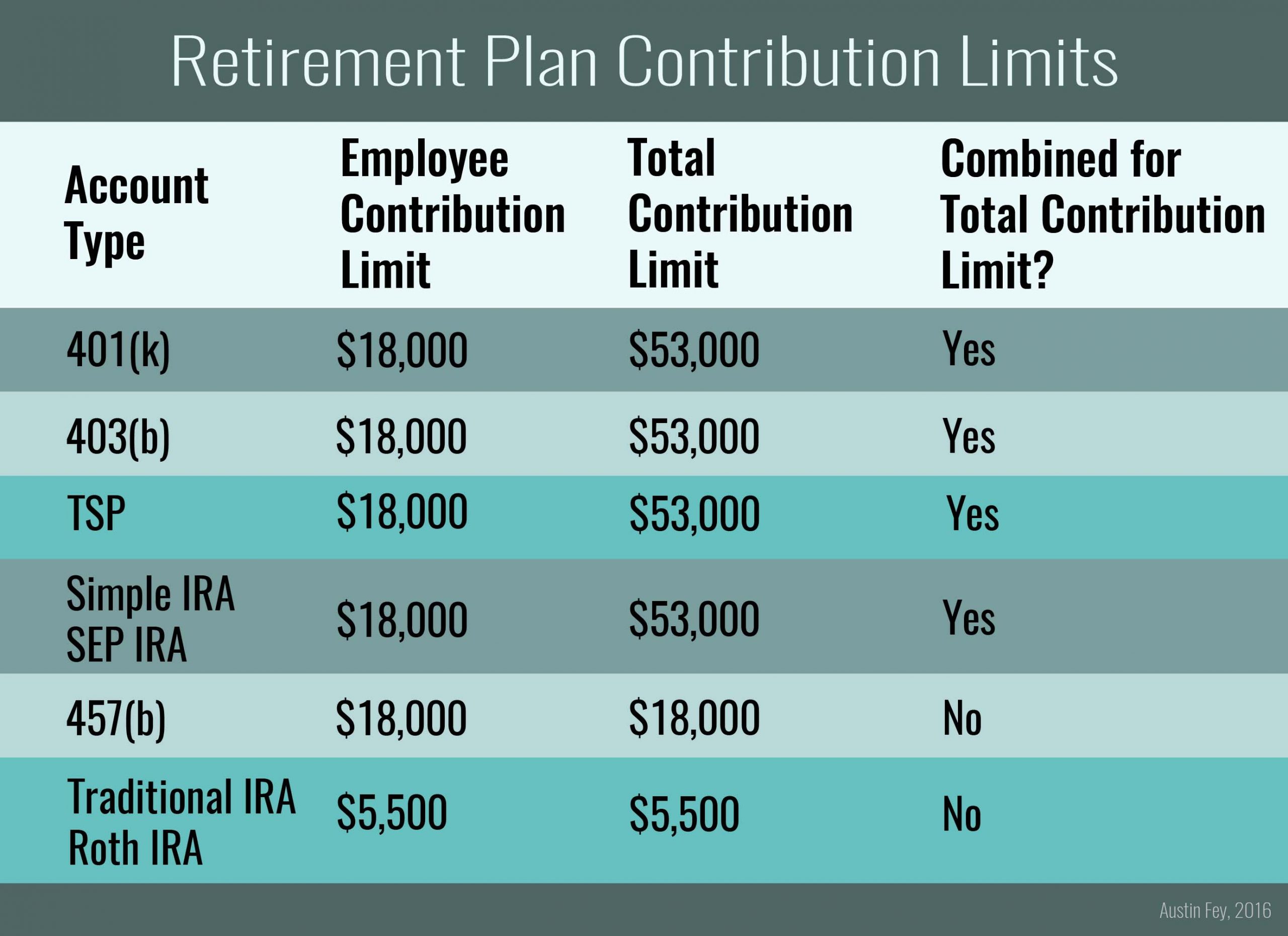

For this plan, your contributions cannot go over $53,000, these are great for self-employed, owner-only businesses and partnerships, and you have to file paperwork once assets reach $250,000.

As both an employer and employee, you can contribute elective deferrals up to 100 percent of earned income up to the annual contribution limit.

You can also contribute 25 percent of compensation, which is defined by the IRS as net earnings from self-employment minus one-half of your self-employment tax and minus the contributions you make to your retirement plan.

You can maximize your contributions if your income is lower than the accepted amount in order for you to get the most out of a SEP-IRA plan.