Popular Mobile Banking Apps That Might Interest You

Like most people, you probably use your smartphone at the bank. But did you know that many different mobile banking apps are out there? And that they all offer different features? Today, this blog post will look at some of the more popular mobile banking apps and see what they offer. Stay tuned.

Soldo

When looking for a spend control solution that makes it easy to manage employee expenses, Soldo is the app you should turn to. It offers flexible spending limits, real-time tracking, and automated expense reporting.

When it comes to the Soldo payment cards, you can set individual spending limits and control who can use them. The ability to use as many cards as you need and manage employee expenses makes this an excellent option for businesses. You can always read reviews regarding the tool on Google.

The app also has a comprehensive dashboard that gives you an overview of your business’s expenses. You can easily see who’s spending what and set up automated alerts to notify you when spending thresholds are exceeded.

Soldo also offers a virtual card feature that allows team members to make purchases with a secure credit card. This is great for businesses that need an effective way of managing employee expenses.

MoneyLion

This is one of the top mobile banking apps out there. It offers a variety of features, including real-time account balances, free ATM withdrawals nationwide, direct deposit and bill pay, budgeting tools, and more.

MoneyLion also offers an impressive array of rewards programs, such as “Round-Ups,” which allows you to save each time you make a purchase, and “Instant Cashback,” which gives you cash back on select purchases.

The easy-to-use app also comes with a financial fitness tracker, offering real-time spending insights and tips to help you stay on budget. This helps a lot when you need to manage your finances on the go.

Chase Mobile

This app allows Chase customers to access their bank accounts quickly, keep track of spending, and transfer money. It also offers unique features like “Quick Pay,” which allows you to quickly pay bills from your phone without logging into a website.

You can also use the app to deposit checks and find nearby ATMs. And if you’re a Chase customer, you can easily link your checking and savings accounts with the app. When using the tool, you can easily keep track of your budget, view spending patterns and get personalized recommendations.

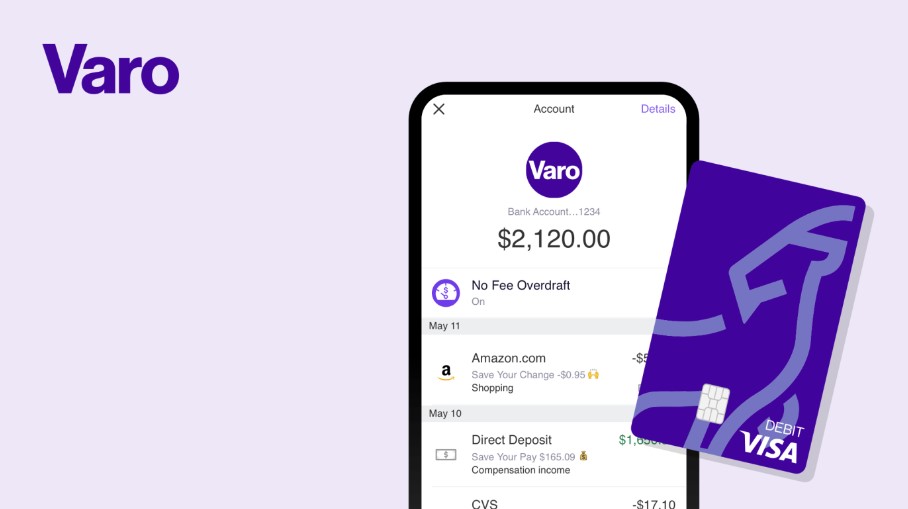

Varo

This app combines traditional banking and budgeting tools with modern technology. It offers several features to help you manage your money, including no-fee checking accounts with no minimum balance requirement, free ATM transactions worldwide, overdraft protection, and real-time account notifications.

The app also has built-in budgeting tools that make it easy to keep track of your spending. You can categorize your purchases and create custom budgets and savings goals. Varo also offers investment options, such as IRA investments, that you can take advantage of if you want to grow your money over time.

Chime

The user experience is everything with this mobile banking app. Chime offers a variety of features, including no-fee accounts with no minimum balance requirement and free ATM transactions nationwide.

The app also has budgeting features that make it easy to see your spending habits and take control of your finances. You can even set up automatic savings goals to help you reach them. The app also has a feature that allows you to separate your money into different categories. This is great for saving up for specific goals, like a vacation or a new car.

Besides, with real-time transaction notifications, you can make sure you’re always on top of your finances. This is particularly helpful when you’re traveling and want to be sure that your transactions are secure.

Discover

This tool is crucial when it comes to rewards. Discover offers cash-back bonuses on purchases made with their debit card. The app also comes with various other features, such as checking your account balance and transferring money from one account to another.

You can set up custom alerts to know when your checking or savings accounts have reached certain thresholds. The app also offers a variety of budgeting tools, such as spending and saving goals. This makes it easy to keep track of your finances and stay on budget.

When redeeming the credit card rewards, you can either cash out or use them to purchase gift cards. With Discover, you get the convenience of managing your money on a mobile banking app and the added benefit of rewards earned with every purchase.

Mobile banking apps make managing your money easier than ever before. Whether you’re looking for an app with features like round-ups or no-fee accounts, these popular mobile banking apps have something for everyone. Use these apps to help you manage your finances, stay on budget and reach your financial goals.