Exploring the Key Reasons Behind the Essentiality of Business Insurance

Insurance is an important element of our lives from health insurance to car insurance to even pet insurance, so if you are starting a business, it is important to remember that insurance for your business is just as essential as any other insurance. If you are just starting out and have no idea how to wrap your head around the complexities of business insurance, read below to see the key reasons behind the essentiality of business insurance.

Risk Mitigation

Every time someone opens a business, they face risks of all kinds. Will the product sell? Will employees be reliable? Will customers respect the property? With all of these questions bouncing around in the brains of new business owners, insurance is an obvious essentiality to ease the mind. Any risks that you can imagine can be covered by the right business insurance. Businesses face a variety of risks every year, if not every day and business insurance can cover costs related to everything ranging from a human error to natural disasters.

For example, let’s say there is a big story one day at your brick-and-mortar business, and the first-floor floods. Business insurance covers the costs of cleanup and repairs and gives you the peace of mind that you don’t have to pay for any of it out of pocket. This is why business insurance is essential for any business because you never know what will happen, and no matter how cautious you are, you cannot control things like extreme weather.

Insurance Based on Your Industry

Every industry differs in its operations, workforce, and products or services. Because of this, each industry needs a specific type of business insurance to cover its needs. To look at the differences between insurance companies like NEXT and Hiscox Insurance compared by professionals, check out InsuranceRanked.com where you can see which industries are covered by which insurance providers and how their rates compare. Some companies only work with certain industries, while others cover a variety of businesses, from the beauty industry to retail.

Some industries have physical locations, while others are completely online, so they have different insurance needs. The right business insurance provider has to understand your industry and the kinds of things that could go wrong with daily operations.

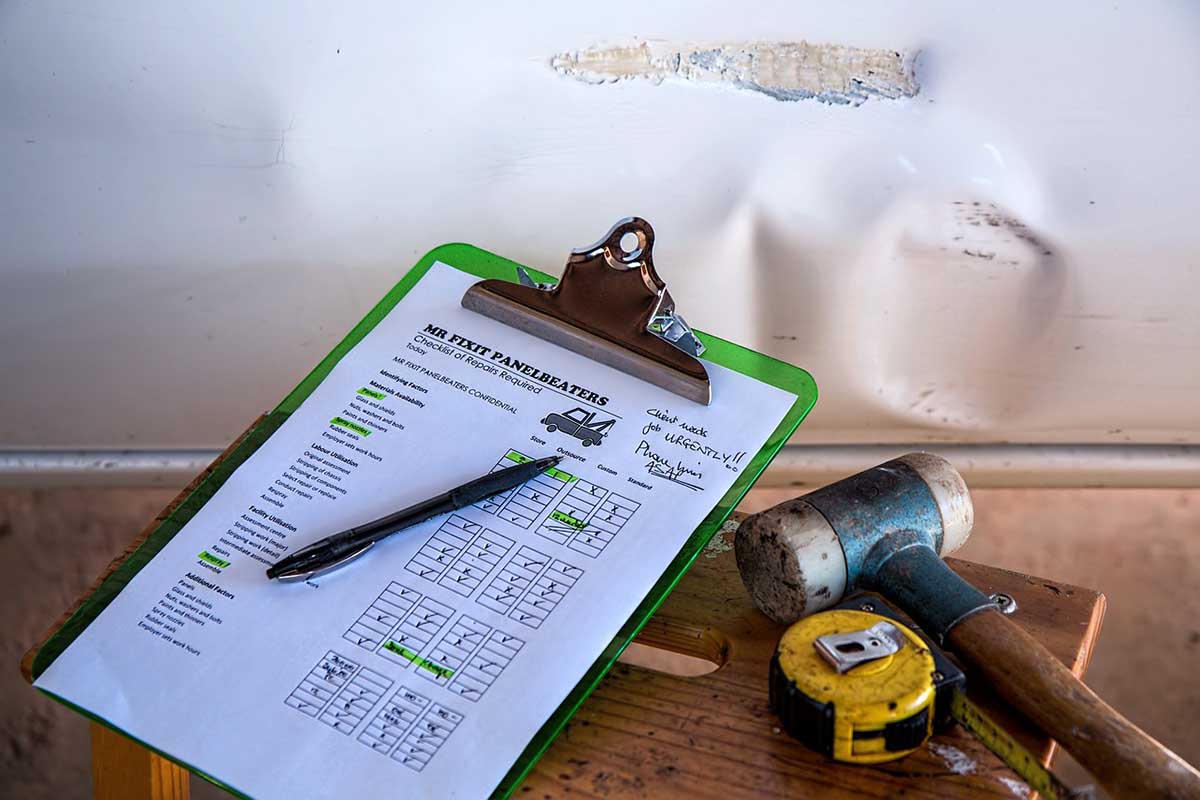

It is essential to have business insurance in the construction industry, for example, because humans interact with equipment that weighs thousands of pounds, and injuries can happen. But it is equally important to have business insurance for an online business because, in this modern world, there are a lot of hackers out there who could access your information and steal information or funds from your business.

Insurance is essential in each industry because no matter what you do day to day, the world is unpredictable, and it is good to have a safety net to catch you if something bad happens. Having insurance does not mean that you are incapable of taking care of your own business, it just means that things happen, no matter how safe you are and it’s better to have a helping hand than to have to pay for things out of pocket and possibly go out of business because of it.

Legal Requirements

When starting a business, you may realize early on that you cannot get certain legal permits or approvals until you have business insurance. This is because any other businesses that want to interact with you will only interact with you if you already have insurance. To run a business legally in the United States of America, you have to have some form of business insurance so that you can operate above board. Sometimes you also are also required to have a certain kind of insurance in certain jurisdictions.

One example of this is that businesses that have a physical location with employees must have workers’ compensation included in their insurance coverage in case any employee gets injured or sick on the job. This kind of requirement is usually mandated by law in certain cities or states. Make sure to check your local laws and regulations before purchasing your own business insurance.

Liability Coverage

Running a business means that you are going to encounter challenges of all kinds, from unhappy customers to challenging employees. Because of this, your business may run into legal trouble at some point down the road. Whether it’s a disgruntled former employee who feels that they were treated unfairly or a customer who claims their product or service was unsatisfactory, business insurance can help your business protect itself from lawsuits.

This is one of the overlooked reasons why business insurance is essential, as new businesses hope they will never have to end up in a legal battle with anyone. It is better to be safe than sorry by investing in this addition to business insurance. The good thing is that most reliable business insurance plans will already include this feature.

Employee Wellbeing

A well-running business is a business where employees are appreciated and looked after. Companies must have insurance that includes workers’ compensation and other features that keep employees protected because otherwise, if employees get hurt or sick while working there and they have no protection, they will likely sue the company. Employees are an essential part of any business and deserve to know they have a safety net if needed.

It is also important to note that if your business does not have workers’ compensation as part of its insurance plan, then you may have a tough time finding employees. Many people will not sign a contract if they do not have any kind of coverage while working at your business. This is why it is essential to have business insurance because it gives everyone who works there peace of mind.

Business insurance may seem intimidating, but it is essential to running a successful and safe business. Remember these reasons as you begin shopping for the perfect business insurance.