Personal Finance Tips You May Need To Know

Money is a big part of any individual’s life. Without having your personal finances in check, you are less likely to enjoy a lifestyle that actually provides you with the convenience and peace of mind you desire.

While actually managing to increase your income might not be something you can do at the moment, you should be looking into financial management solution that will allow you to ease some of the worries you have in this department.

When you wish to boost your quality of life, you need to first make an effort in obtaining optimal monetary control. There are plenty of actions that you have the possibility of pursuing, and a few useful suggestions from investment firms in Pittsburgh remain the following:

Personal Finance Tips: Budgeting

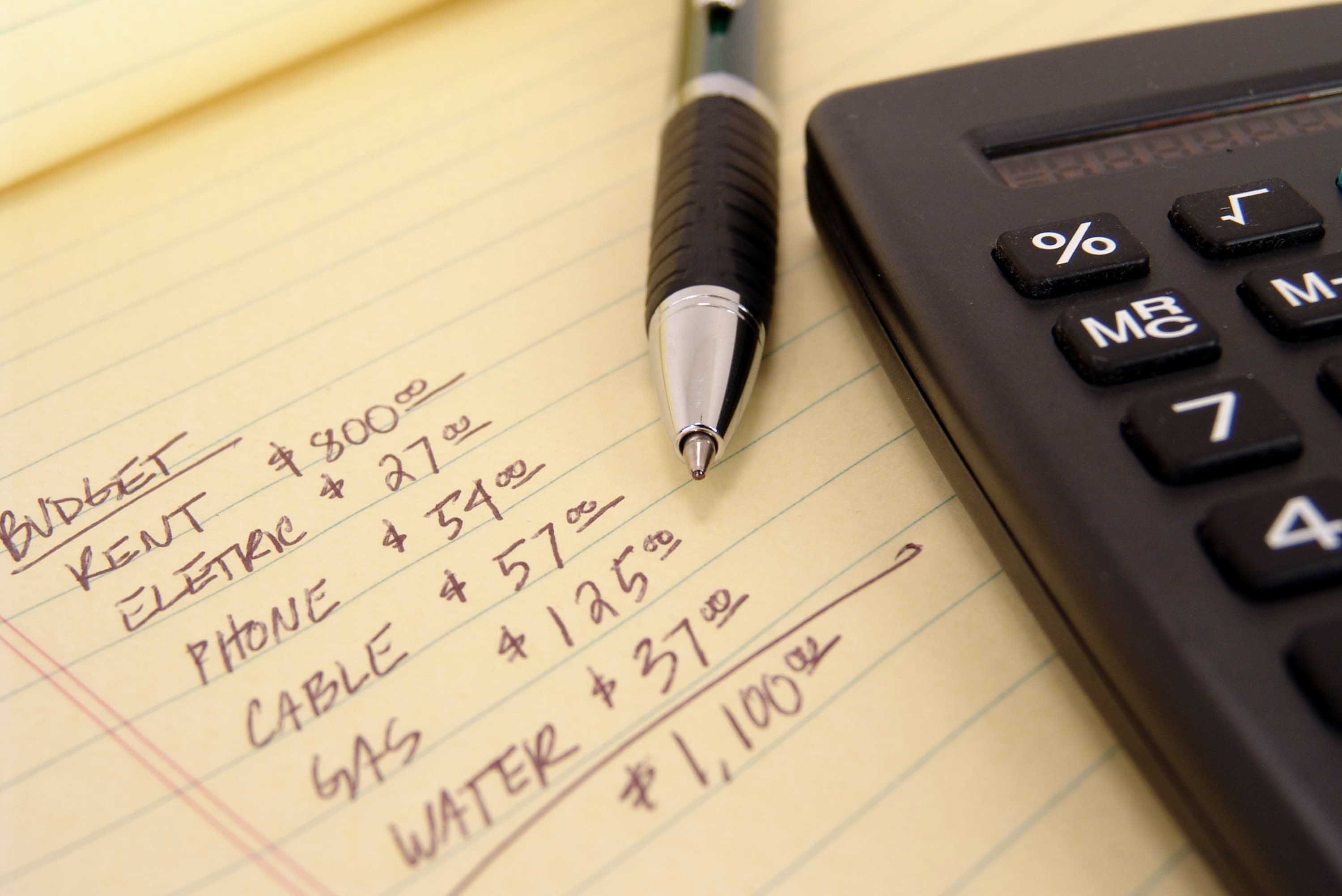

Budgeting isn’t exactly fun, so many people tend to neglect to do it, but when your personal finances aren’t great, it’s time you put in the necessary effort and develop a budget plan that can actually work for you.

Working on a budget becomes essential when you’re bad with money. What you can do here is list out all your expenses, do the math, and see where the money is being wasted or how you can cut down on certain costs.

Once things become a bit clearer for you, and you have developed a budget plan that you think is reasonable for your lifestyle, make sure to stick to it. Each expense should be written down – perhaps you have a new bill you need to cover, or unpredicted spending has arisen – to maintain your budgeting in-check, keep track of every expense.

This will help you become more organized financially, and naturally, it will help you decrease monetary concerns.

Write off your debt

One of the biggest impediments you may be currently dealing with, in the financial department, might have something to do with multiple debts. Having to cover several debt payments each and every month can be a hassle – unreasonable rate interests, deadlines, and other inconvenient details that are probably causing a lot of stress.

Accessing financial freedom will not be possible until you solve things here. Well, nowadays, those who are finding it difficult to keep up with repayments can look into debt consolidation solutions.

There are various opportunities that will allow you to write off your debt, and be left with just one single monthly payment. In just about 5 years you could be entirely debt-free, and your biggest assets, such as your car or home, won’t longer be put at risk.

Being constantly contacted by creditors when you are missing deadlines may be an issue you are dealing with at the moment, well, with the right formal debt consolidation method, such as an individual voluntary arrangement, you can escape this inconvenience as well and prevent yourself from facing a potential future bankruptcy scenario.

You can check on this site what eligibility characteristics you need to meet in order to actually apply for debt consolidation. With your debts no longer on your mind, your personal finances will naturally benefit from improvement.

Are you accessing the best prices?

You would be surprised to discover how much of a difference it can make to start comparing prices when you are on the point of buying something.

Some supermarkets offer more affordable deals on the same products, brands that offer basically the same quality might have different prices due to popularity reasons, and a wide variety of coupons could be available for the items you are buying regularly.

Switch to more generic brands, look into deals and coupons on the internet, and compare prices between the grocery stores you are frequenting, and you will see for yourself, that you can end up saving a reasonable amount of money with virtually no effort on your part.

Adopt habits that prevent you from making compulsive purchases

Compulsive shopping is a real problem that many individuals deal with, regardless of financial situation. This might be the thing currently holding your finances down, and preventing you from saving money or reaching stability.

From home appliances to clothes and even groceries, you may be wasting quite a lot of money on some item you could easily leave without. It’s important to form a few habits that will prevent you from overspending from now on.

Never going grocery shopping on an empty stomach and always having a grocery list with you, getting rid of credit cards, and starting to buy only what you can really afford. Unsubscribing from any newsletters that might tempt you to shop for things you don’t actually need – these are a few examples of actions that can actually help you to ease your compulsive shopping behavior.

Consult a financial advisor

For situations that are actually more serious – when you need a bit of support to get out of a financial crisis – it’s best if you simply resort to a professional who can help you assess your case by the book and provide you with optimal solutions. A financial advisor will be able to point you in the right direction.

Personal Finance Tips: Perseverance and practice

One last thing you need to remember is that becoming good with money isn’t something you can do in just a couple of weeks. You need to keep yourself focused on your personal financial objectives, and to keep practicing these new financial habits you have developed.

It will take some time until these things will actually become part of who you are. As you can see, there are quite a few useful things you can consider doing, if you want to boost your quality of life and handle your finances better.

Proper financial management can stand at the base of an optimal lifestyle, and often, the most effective solutions are the easiest ones to implement, you just need to be thoroughly informed and pursue the right course of action on the matter. Take into account these ideas, and choose the option you think would work for your specific situations best.

Consider our personal finance tips: from writing off your debt to proper budgeting, each one of these suggestions could provide you with great outcomes – money shouldn’t be an impediment to your lifestyle choices.