Best Money Management App To Get You Financially Healthy

Money is a stressor that too many of us have in common.

Whether it’s billed rising or surprise expenses -it’s easy to worry about your finances. Organizing your money with finance apps can do wonders for improving your financial health.

If you’re not sure where to start in 2020, one of these four financial apps could be exactly what you’re looking for.

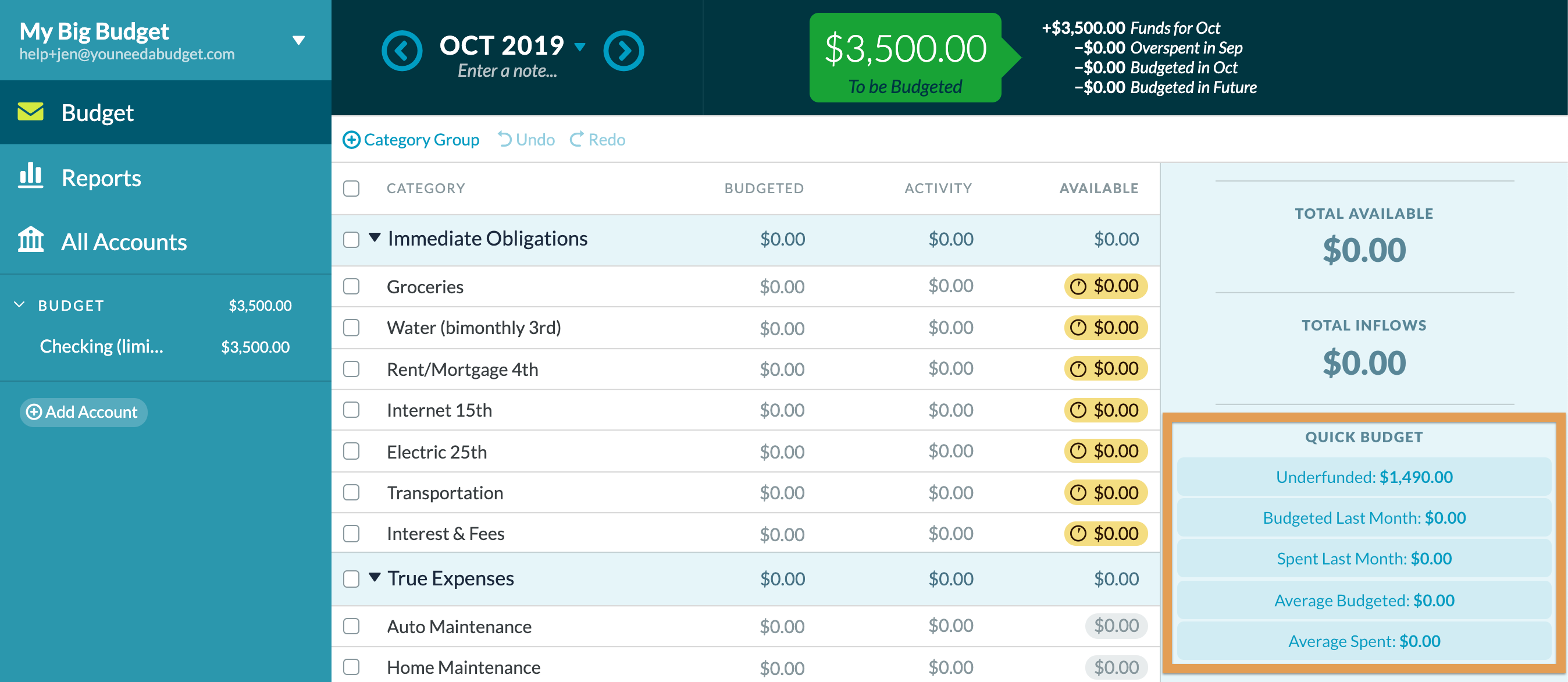

YNAB

‘You Need a Budget’ is an app that follows four simple rules. The first of those rules is called ‘ Give every dollar a job.’ The basic idea behind this rule is that you pre-plan what you will be doing with all of the money that comes into your account.

The second rule is to ‘Embrace your true expenses.’ To adhere to this rule, you create a goal to save for your larger infrequent expenses.

Rule three is ‘roll with the punches’ (which refers to keeping calm and adjusting if you overspend)! The final rule is all about ‘ aging your money.’

The plan here is (ideally) to get to the point where the money that you are spending was earnt months before. When this occurs- it will reflect some real healthy finances!

With YNAB, budgeting is simplified and aligned with your personal goals.

Monefy

Monefy is a great expense tracker that allows you to monitor exactly how much you spend. There’s no more guesswork or hassle in finding out what you’ve spent in a week or month etc.

Monefy presents each one of your expenses in a pie graph, so it’s simple to track where you may need to make cuts or adjust your spending. There are green and red buttons for users to record expenses and incomes, so once you get into the habit- the whole thing is really simple.

Spendee

Spendee is one of the excellent finance apps that lets you design shared wallets with your family, partner, or roommates. It’s super easy to organise your budget as a household.

The Spendee app will categorize your bank transactions, and you can add cash expenses manually too. Spendee helps you to stop going over your budget by tracking your spending as you move closer to each set budget.

There’s a bill tracking function that ensures that you will never miss any deadlines, and thus you’ll avoid stress or late fees.

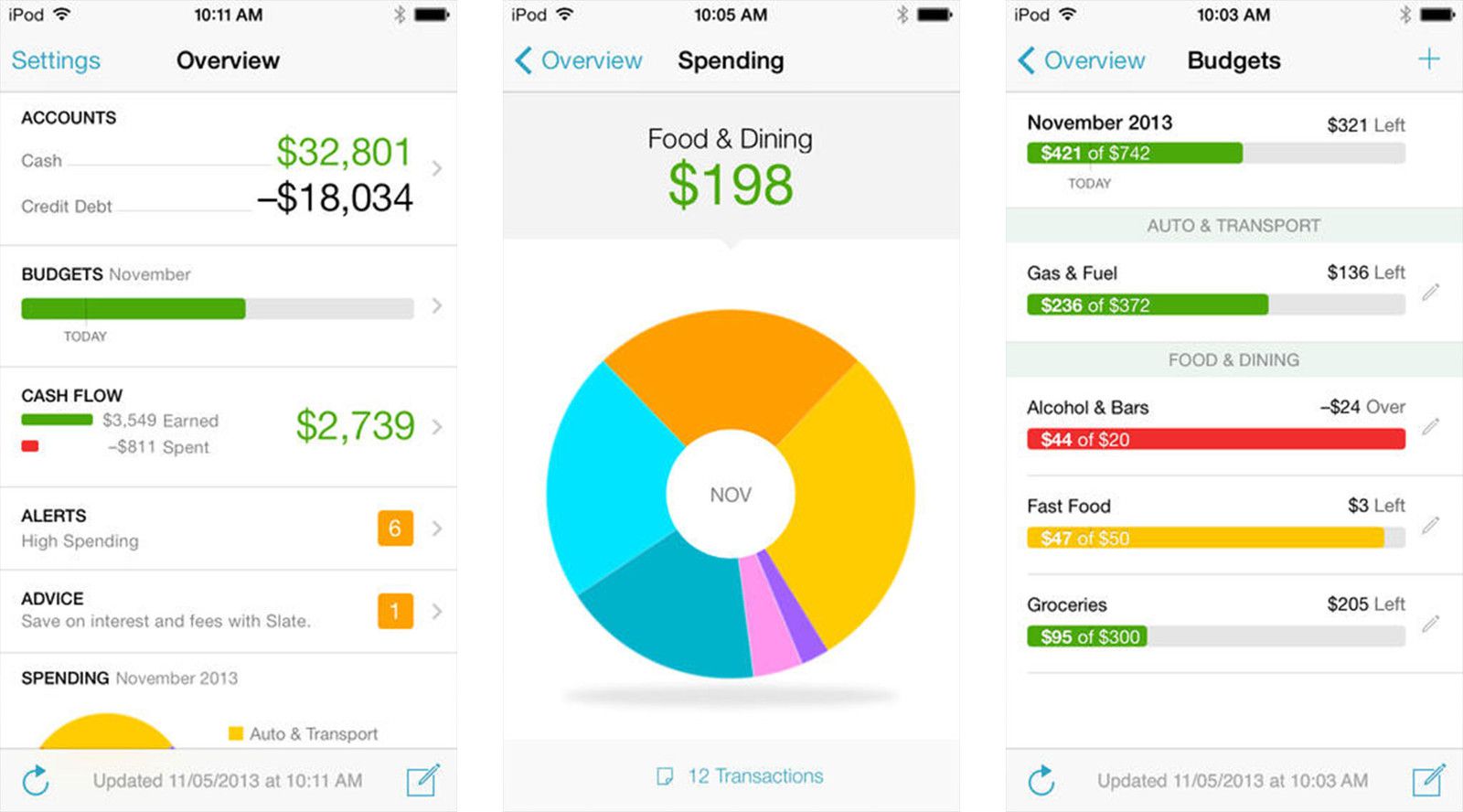

Mint

Mint is one of the most popular finance apps, and for a great reason! This app links all of your accounts, loans, or debts together so that you can manage everything all in one place.

You can track all of your expenses and design a budget for each category, from rent or mortgage to groceries or leisure. Mint also allows you to access your credit score for free. With the help of Mint, you’ll soon be managing your money with the skill of a financial planner!

When it comes to your financial health, making a few adjustments to your household expenses can go a long way. Shop around and see if you can find a cheaper quote on your energy provider, or give a discounted supermarket a try.

When you renew your mortgage, use sites like Altrua at https://altrua.ca to find yourself a better deal. If you want to see more leftover each month, every little contribution is worthwhile.