How To Manage Cibil Score Better – All You Need To Know

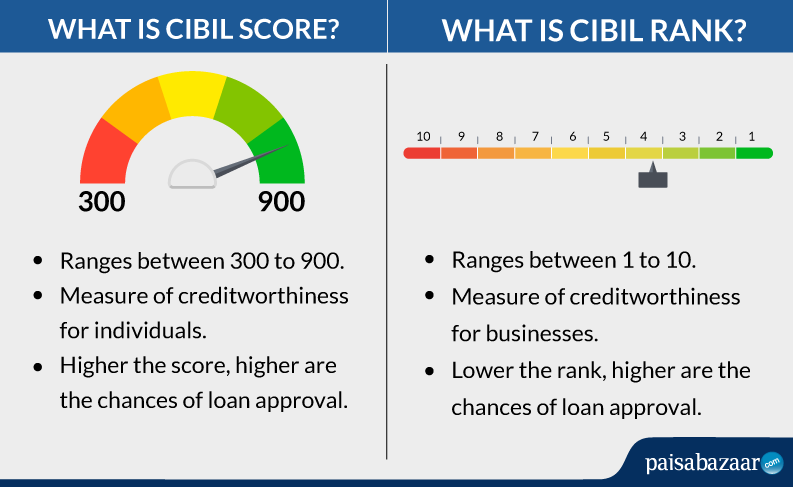

A CIBIL score is a three-digit numeric value generated by the Credit Bureau based on the summary of your credit history. It is viewed from your Credit Information Report (CIR), which gives an overview of all your loans and repayments.

Having a high CIBIL score indicates that you are a responsible borrower and lets you enjoy lower interest rates. The higher your CIBIL, the more lucrative offers and rewards you get from banks and financial institutions. A score above 700 is considered good by many organizations, while anything below 350 can risk getting you blacklisted or shunned.

If you’ve been trying to improve your CIBIL Score or have no credit history and want to get started, here is what you need to do. Follow these tips and learn how to improve CIBIL Score today below.

Always Make Timely Repayments

This is the no. 1 golden rule when it comes to raising your CIBIL. Push to make payments before the due dates and make them in full. Do not ever default on payments since defaulting can lower your score. It’s much harder to increase your CIBIL score once the value drops. So try to avoid it by paying back on time.

Apply For A New Credit Card

This tip applies to those who have never had a credit card. If you’re wondering what is a credit card, it’s a card that lets you borrow money from the bank and get charged interest for loans. The difference between credit and debit cards is that credit cards increase your credit limit naturally. They increase your CIBIL score when you use don’t overspend, stay below your credit limit, and make repayments on time. It’s an easy way to increase their CIBIL score for those who don’t have a credit history.

Clear Any Disputes In Reports Immediately

It can be normal for financial institutions to make a mistake when updating your records. If you think that’s the case, file a dispute and raise it to CIBIL. They can review your report and take a look at your previous financial transactions. And once the errors are spotted, CIBIL will fix them. Your score will automatically improve after the disputes have been cleared.

Add Old Debts To Your Report

Old debts include any loans and borrowed amounts you’ve cleared in the past. It could be your EMIs, car loans, or any payments you’ve made for your home loan. A lot of new credit card owners make the mistake of scraping these details off their report. Don’t do that.

If you have good debt, you can highlight it on your credit report, which can, in turn, improve your CIBIL score. It’s basic but often overlooked.

Keep Your Credit Utilisation Ratios Low

Don’t risk making random repayments when it comes to clearing your dues. Any sudden fluctuations in repayments is a bad indicator. Besides this, don’t use up your entire credit limit when you get a credit card. Keep your usage minimum and your credit utilization ratio at around 30% or less. Higher credit utilization and late payments will affect your CIBIL score negatively.

Request Your Bank For A Boost In Credit Limit

Having a higher credit limit doesn’t mean you get to spend as much as you want. But it does give you financial freedom, flexibility, and various perks. One of the biggest benefits of getting a higher credit limit is that it improves your CIBIL score. When your application for a higher credit limit gets approved, it shows that you are a responsible borrower.

Don’t spend beyond your means, and always use credit based on your repayment capacity.

Do Not Go For Joint Loans

If you are taking a loan and thinking of having a joint applicant for it, avoid it. The reason is that even if you don’t default on your side of the payment, it could negatively impact your report. If your joint applicant has a poor credit history and defaults on their new loan, you’ll take a hit.

Manage Cibil Score: Try Credit Card Repayment Services

Credit Card repayment services like CRED consolidate all your credit card bills and make paying them back on time easier. If you have multiple credit cards, you can make a full repayment for all pending balances at once. CRED is directly linked to CIBIL and recognized by banks and financial institutions. Plus, it’s free, which makes it worth using. You can get the online app by visiting the official website, but you need a good CIBIL Score.

Manage Cibil Score: Do Not Take More Loans

If you already have any pending loans, defaulted before, and thinking of taking additional loans, don’t do it. Taking on more loans, in addition to your existing debt, will lower your CIBIL score. This seems pretty obvious, but a lot of borrowers make this mistake. Clear your existing loans first, work on raising your existing CIBIL score, and then apply for new loans. It’s much safer that way, and you don’t have to risk anything.

Why Is Having A Good CIBIL Score Important?

When you face uncertain times or need emergency funds, you will be able to take out loans without any problems. Having a high CIBIL rating also means that your loans will get disbursed quickly. You won’t have to go through the hassle of applying and jumping through many hoops for new loans. A high CIBIL score also authenticates you as a reputed borrower and verifies your identity to various international banks and financial organizations. It’s recognized globally, which is its biggest advantage.

Manage Cibil Score: Conclusion

Increasing your CIBIL score is not just a matter of luck, but patience, financial discipline, and consistency. Take care of your financial health, and you will find your CIBIL number slowly going up. A good rule of thumb is maintaining a good credit standing for at least six months to let it increase naturally. If you’re in a cash crunch and having a tough time clearing your existing debts, you can try out debt consolidation services. But avoid defaulting and always pay back on time.

Once you get a higher CIBIL score, a lot of doors will open up. Banks offer credit cardholders with higher CIBIL scores various benefits such as discounts on air tickets, complimentary lounge access, offers on restaurants, and so much more. You will also be able to apply for premium credit cards and upgrades when you have a good CIBIL score in your report.