AI Investment Trends 2026: Where Global Investments Moved After the AI Hype Faded

✨ Key Points

AI investment trends 2026 show that AI is no longer the product it’s the mechanism inside profitable workflows.;

Capital is moving toward infrastructure, automation, and measurable outcomes;

Speed, margin, and scalability now matter more than novelty.

What Is Actually Growing Going Into 2026 and Why

Across global data from CB Insights, Crunchbase, and PitchBook, one pattern is consistent: capital is concentrating around AI that disappears into operations and reappears as financial leverage.

By mid-2025, more than half of new AI funding rounds globally were tied to enterprise automation, infrastructure, or industry-specific workflows rather than general-purpose tools, according to aggregated venture reports.

Another analysis showed infrastructure and compute-related AI deals growing at roughly twice the rate of consumer-facing AI applications.

Here’s where that money is actually going.

AI Investment Trends 2026: From Hype to Infrastructure ROI

The AI investment trends 2026 cycle is no longer about chatbots or experimental pilots. It’s about AI infrastructure ROI and measurable operating margin expansion.

Investors are prioritizing:

GPU-as-a-Service (GPUaaS) platforms powering scalable AI workloads;

Enterprise automation funding for workflow replacement, not enhancement;

Micro-nuclear energy projects supporting AI data center expansion;

Industry-specific AI systems embedded directly into compliance, logistics, and finance;

This marks the transition into the post-hype AI market, where funding follows efficiency gains, cost compression, and durable enterprise contracts.

The CFO’s 2026 AI Investment Filter

CFOs asking, “Does this reduce operating expenses within 12–24 months?”

In 2026, enterprise AI funding decisions increasingly pass through a financial lens:

Clear Infrastructure ROI – Does the AI deployment reduce labor, energy, or processing costs?

Capital Efficiency – Is GPU-as-a-Service more cost-effective than owned hardware?

Energy Stability – Can micro-nuclear energy or alternative power reduce long-term data center volatility?

Operational Leverage – Does automation replace workflows or merely assist them?

This financial filter is driving enterprise automation funding into systems that directly impact EBITDA, not vanity metrics.

📊 Quick Comparison: 2024 Hype vs. 2026 Reality

| Feature | 2024 “Hype” Era | 2026 “Applied” Era |

| Investment Goal | Market Share & Novelty | EBITDA & Operational Leverage |

| Primary Tool | General Chatbots (LLMs) | Specialized Agents & IDP |

| Energy Strategy | Grid-Dependent | Sovereign / Micro-Nuclear |

| Success Metric | “User Engagement” | Reduced Transactional Cost |

1️⃣ AI for Document Handling and Operational Processes

Contracts, invoices, technical specs, compliance paperwork—this is where time, money, and errors quietly leak.

Automating interpretation and turning documents into actions shortens cycles and reduces risk in ways CFOs immediately understand.

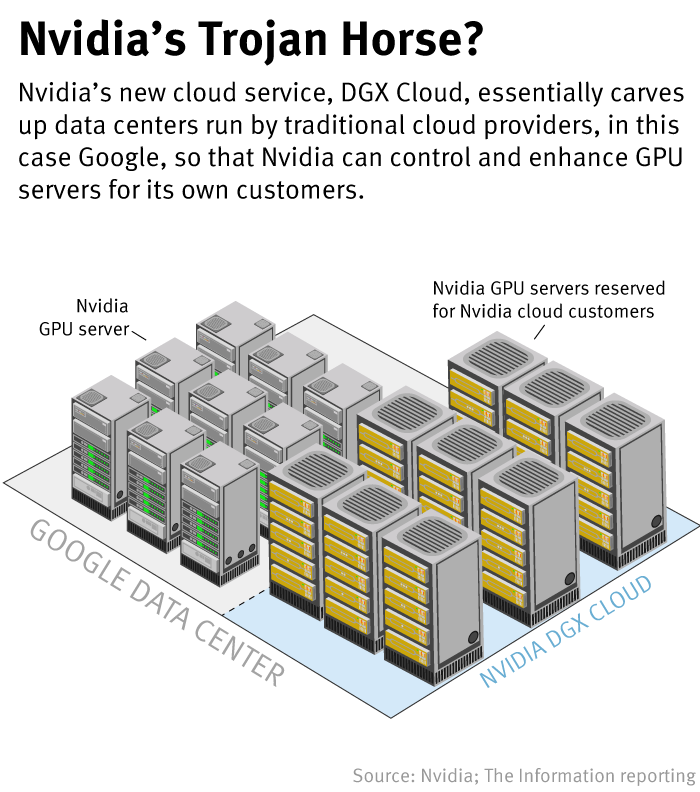

2️⃣ GPU-as-a-Service and AI Infrastructure

Owning compute is starting to look like owning generators in the early electricity era.

Elastic, service-based access wins on reliability, pricing power, and speed. Infrastructure is where AI becomes a utility, not a pitch.

3️⃣ AI Agents for Rapid Product and Content Creation

The value here is not creativity, but velocity. These tools win when they compress iteration loops for teams that already know what they’re building.

4️⃣ Wearable Healthtech With Clinical-Grade Accuracy

Investors aren’t betting on novelty. They’re betting on long-term data relationships, reimbursement pathways, and subscription economics built on hospital-level precision at home.

5️⃣ Emotion AI and Pet Tech

Pet owners pay consistently, stay loyal, and share data freely.

Combined hardware–software ecosystems in this space are quietly becoming high-margin, high-retention businesses.

6️⃣ Fitness and Well-Being With Revenue-Share Models

The shift away from advertising toward aligned incentives is expanding into corporate wellness and B2B. Platforms grow only when outcomes improve.

7️⃣ Mobile and Micro-Nuclear Energy

AI infrastructure consumes enormous energy. Energy is no longer a side concern—it’s strategic. Solutions here are becoming foundational, not optional.

8️⃣ Marketing as an Investment, Not an Expense

Equity- and revenue-share models align incentives and reduce friction. Funds increasingly prefer platforms that grow only when their customers do.

AI Investment Trends 2026

Toward the end of 2025, something shifted that didn’t make headlines but quietly changed how people felt about the future of AI, especially in the U.S., where dominance had long felt unquestioned.

Capital tightened, growth slowed, and American companies that once led with confidence began facing sharper global competition and much tougher internal scrutiny, which subtly but decisively changed the tone of AI conversations.

Around the same time, voices like Ethan Mollick started focusing less on raw capability and more on whether organizations were actually ready to absorb AI into real work, while Ben Thompson kept returning to the same conclusion: AI had stopped being interesting as a product and started mattering only as infrastructure inside systems that already worked.

Even Sam Altman began framing value less as breakthrough magic and more as something that depended on integration, scale, and real willingness to pay.

You could feel that shift immediately.

Across board meetings, partner updates, and investor calls, AI investment trends 2026 started showing up in real time.

The demos were still impressive—agents coordinating tasks, documents summarized instantly, dashboards lighting up with insights—but the excitement gave way to a pause shaped by a tougher economic reality.

The question stopped being “Is this impressive?” and became “Where does this live inside the business, and who’s paying for it?”

If you’re an early-stage founder or a corporate innovation leader, you probably felt that moment before you had words for it, when “it’s AI-powered” stopped sounding like an answer and started sounding like the start of a much harder conversation.

This article is about what actually changed, why AI investment trends 2026 made so many capable teams feel behind when they weren’t, and how to build a defensible thesis for 2026 that survives contact with budgets, procurement, and reality.

If you want, I can cut this even harder, or make the opening more provocative around U.S. vs global AI power.

Seattle’s Strategic Role in the 2026 AI Investment Landscape

Seattle offers a powerful geographic advantage in this transition.

As home to cloud giants like Microsoft and Amazon, the region sits at the center of global AI infrastructure development.

Seattle-based cloud leaders are increasingly aligned with the shift toward GPU-as-a-Service models, enabling enterprises to scale compute without heavy capital expenditure.

At the same time, the Pacific Northwest has become a key testing ground for advanced data center energy strategies including exploration into micro-nuclear energy partnerships to stabilize power supply for AI-intensive workloads.

This local concentration of hyperscale cloud infrastructure strengthens Seattle’s authority in shaping AI infrastructure ROI strategies and enterprise automation funding models.

In short, the 2026 AI investment cycle is infrastructure-first, CFO-approved, and increasingly anchored in regions like Seattle that combine cloud scale, energy innovation, and enterprise deployment expertise.

The Shift That Wasn’t Announced—but Was Widely Felt

For a few years, the market behaved as if AI itself was the product.

If it used large models, agents, or anything that looked autonomous, the assumption was that value would materialize later.

That belief became so normalized that many founders stopped questioning it. If it’s AI, it will raise. If the demo is good enough, ROI can wait.

If agents are involved, the product must be defensible.

By late 2025, that spell broke.

Not because AI stopped working, but because investors and operators stopped mistaking intelligence for leverage.

Capital didn’t leave the market. It simply stopped rewarding ambiguity.

Questions shifted from what it could do to where it actually sits inside the business, who pays for it, what it replaces, and how quickly the financial impact shows up, which is exactly what AI investment trends 2026 have been signaling all along.

This wasn’t a rejection of innovation, but a correction back to fundamentals.

Feeling Late While Everyone Else Sounds Certain

One of the most common conversations I hear right now starts with a quiet confession.

“We feel like we’re late to AI.”

What they usually mean is not that they lack technical capability, but that everyone else sounds more confident. LinkedIn is full of decisive takes.

Pitch decks look polished. Other teams seem to have a thesis, a category, and a roadmap that fits neatly into a headline.

Inside your own company, it feels messier.

You see integration friction, security reviews, procurement cycles, and customers who say they want AI but still buy like it’s a line item, not a revolution.

That contrast creates the illusion that you missed the window.

The truth is almost the opposite.

Most of the companies now attracting serious, durable capital are not early to AI at all.

They are late enough to know exactly where it creates leverage, and disciplined enough to ignore everywhere else.

The Pressure to Chase What’s Loud Instead of What Pays

Another pattern keeps showing up in roadmap reviews.

One quarter it’s agents everywhere. The next it’s copilots.

Then vertical LLMs. Then open-source fine-tuning. Strategy starts to drift.

Teams optimize for what sounds current rather than what compounds.

This is where a comforting lie sneaks in: telling yourself you’ve tried every approach, when in reality you abandoned most of them before they had a chance to work.

It’s not that the method failed. It’s that you gave up on day three, told yourself it was the wrong strategy, and moved on to something that looked more exciting.

Markets don’t reward excitement. They reward endurance in the right place.

Confusing Intelligence With Impact

A lot of teams are still quietly operating under the belief that agents are the product.

They’re not.

Agents are a mechanism, like APIs were a mechanism, like cloud infrastructure was a mechanism.

Customers do not buy intelligence in the abstract. They buy fewer errors, faster turnaround, lower costs, and clearer accountability.

When agents don’t collapse into those outcomes, they become impressive demos that struggle to find a budget owner.

That’s why so many projects stalled in late 2025—not because they were bad, but because they never earned a home inside the organization.

“This is the future”

I remember sitting in a strategy session with a team that had built something genuinely excellent.

It parsed complex documents, extracted obligations, generated tasks, and surfaced risks faster than any human team could.

The demo ran perfectly. The room nodded along. Someone even said, “This is the future.”

Then the CFO, who had been quiet, asked a single question.

“Which department loses headcount if we deploy this?”

No one answered right away.

That silence wasn’t a failure of technology. It was a failure of positioning.

The system was intelligent, but it wasn’t yet embedded in a cost center, a workflow, or a P&L line.

In that moment, it became clear that intelligence without integration is just performance art for technologists.

The Illusion That Needs to Break

You were taught that hard work and technical brilliance guarantee success. So you built more, optimized more, and worked longer hours.

When results didn’t follow, the conclusion felt personal.

The uncomfortable truth is simpler. Markets don’t reward intelligence. They reward leverage. And leverage lives inside systems that already move money.

It’s not perfectionism holding you back. Calling yourself a perfectionist is easier than admitting your insight was never embedded where decisions get funded.

It’s not that you’ve tried everything. You just haven’t stayed long enough in the unglamorous parts where value compounds.

A Clear Decision Framework for 2026

If you’re problem-aware and trying to regain footing, use this filter relentlessly:

Can you name the exact workflow this replaces?

Can you identify the budget owner without guessing?

Can you quantify time, cost, or risk reduction within 90 days?

Does AI become invisible once it’s working?

If most answers are no, it’s not a bad idea. It’s just misaligned.

Where This Leaves You

You don’t need to invent the next AI breakthrough to matter in 2026.

What actually moves the needle is doing the work most teams skip: researching how people operate, understanding where decisions get made, and embedding intelligence directly into workflows where money is already moving.

The teams that are pulling ahead aren’t louder or flashier; they’re clearer about the problem, the buyer, and the moment where AI quietly removes friction instead of demanding attention.

That clarity doesn’t just shape the product, it shapes the research, the story you tell internally, and the way your solution survives real conversations with customers, budgets, and procurement. Over time, it becomes your thesis, your narrative, and your advantage.

❓ Frequently Asked Questions: AI Investment in 2026

Q: Why is 2026 being called the “Year of AI Reckoning”?

A: After the speculative hype of 2023–2025, 2026 is a “reckoning” because investors have shifted from funding raw potential to demanding measurable P&L impact. Capital is no longer flowing toward generic “AI-wrapper” startups; instead, it is concentrating on companies that embed AI into specific, high-value workflows with clear revenue-share or cost-reduction models.

Q: What are the most profitable AI growth areas beyond the hype?

A: Real growth in 2026 is found in three specific “back-end” sectors:

Intelligent Document Processing (IDP): Automating complex operational handoffs in legal, finance, and supply chain.

GPU-as-a-Service (GPUaaS): Providing elastic, utility-based compute for specialized enterprise needs.

Agentic AI for Operations: Moving beyond chatbots to autonomous “agents” that execute end-to-end tasks like vendor onboarding and procurement.

Q: How does the “GPU-as-a-Service” model differ from traditional cloud computing?

A: Unlike traditional “one-size-fits-all” cloud stacks, GPUaaS (often called “Neoclouds”) provides specialized, high-performance hardware specifically optimized for AI training and inference. In 2026, this has become a utility—similar to electricity—allowing businesses to scale AI infrastructure without the massive capital expenditure of owning physical servers.

Q: Why is “Micro-Nuclear Energy” suddenly part of the AI investment conversation?

A: AI infrastructure is incredibly power-hungry. By 2026, the energy grid has become a primary bottleneck for data centers. Investors are now backing mobile and micro-nuclear solutions as a foundational layer of the AI stack to ensure that “AI Factories” have the stable, sovereign energy source required to run 24/7 without overloading local grids.

Q: How can a business owner tell if an AI tool is an “investment” or an “expense”?

A: Use the 2026 ROI Filter: If the tool cannot name the exact manual workflow it replaces, identify a specific budget owner, and show a measurable risk or cost reduction within 90 days, it is likely an expense. Real AI investments in 2026 are “invisible”—they work quietly within existing systems to create financial leverage.