Car Loans and Credit Scores: Minimum Credit Score to Buy a Car

What is the minimum credit score to buy a car? Car loans are loans a person takes to purchase a motor vehicle. Credit scores are three-digit scores that stand for your creditworthiness. Both car loans and credit scores go hand in hand, and you have to be well-informed about the scorings for title loans for semi trucks.

What is Considered a Bad Credit Score

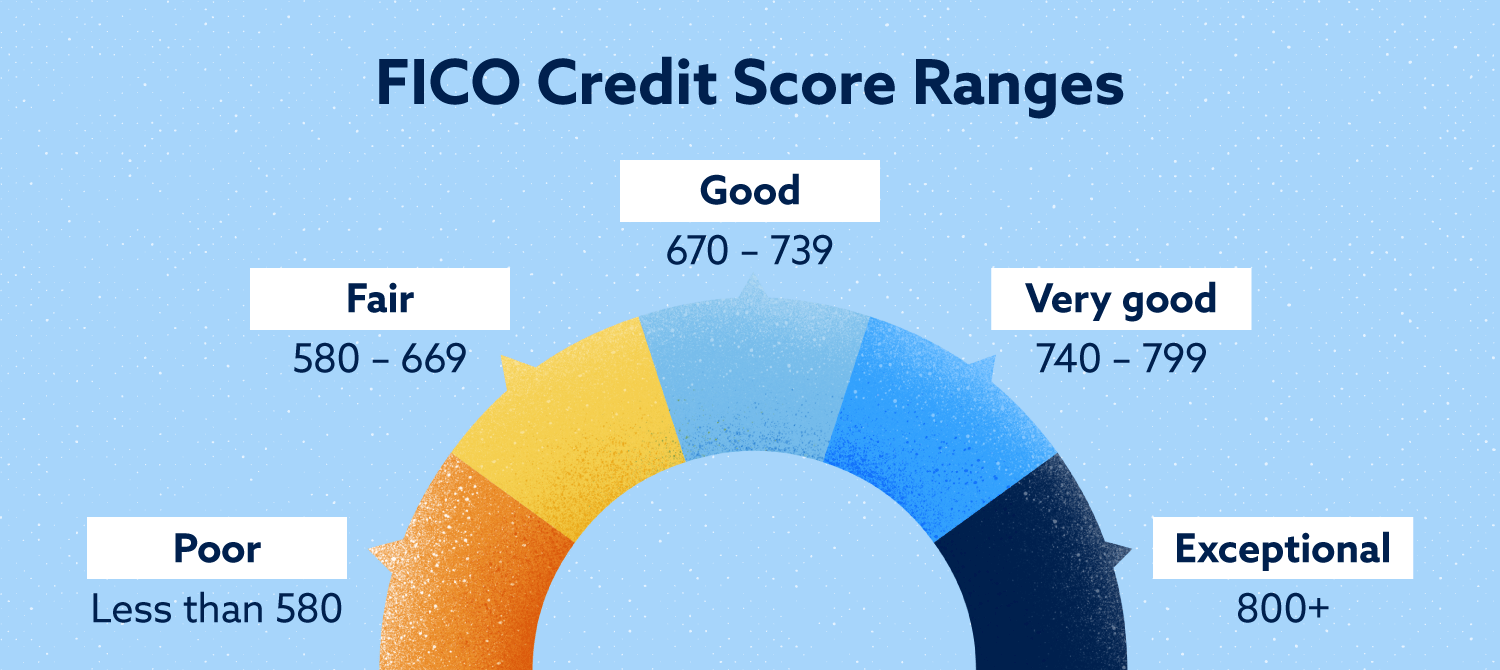

Look at the three-digit score ranges that are crucial to your car loans. Below is a simple analysis that provides a complete listing of every credit score.

FICO Credit Score Ranges

To make it easier for you to understand, 750-850 refers to great credit, 680-719 as good credit, 630-679 as fair credit, and 520-629 lists down as subprime 300-549 as bad credit. Of crucial importance is that you have to understand the APRs to compete with the highest credit scores. Understand the APRs so that when you’re ready to buy the vehicle, you know what to receive from your lender.

The lower your credit score, the less your chances are for auto loans. The chart shows that borrowers with bad credit scores of 499 or below will experience a 4% percentage of auto-loans while 20% of auto loans avail for 599 or below borrowers. With a good credit score, you can apply for loans at any given time do month or year. Moreover, your credit score determines that you don’t have to pay a high-interest rate.

In the case of a bad credit score, your interest rate will likely be large and complex compared to borrowers with a good credit score. Having a bad credit score is radically challenging from a good credit score as it tends to freeze your chances of auto-loans. Your financial security demands the strength of your credit score.

Guaranteed Auto-Loans with Bad Credit Score

Many online websites give you total control with the ability to build your deal with a payment you can afford. You can still qualify without impacting your credit score to finance and see payments with the car of your choice. You can also get loans in Austin with a minimum credit score and build a payment deal according to your convenience.

It’s convenient and easy to quickly look at your options and determine your flexibility with your interest rate, payment, down payment, and more. Make sure you go with a reliable company, an online company or your well-known car dealership.

A great example of a car vendor is this Volkswagen van dealer of 2021 UK. You can have the most comfortable car deal from quickly navigating the website to speaking with the company. Another essential thing to note is that the online refinancing process makes it easily accessible.

With immediate offers, you can evaluate your rate in minutes and instantly see the eligible offers. You can also look up guaranteed auto loans with bad credit reviews online with ease.

You can also try local dealerships, which will cut your time in half, reducing the lengthy buying process. Dealership professionals learn how to sell and service more vehicles more profitably. Professionals like tyler auto finance would be able to help you every step of the way toward getting that vehicle!

Fastest ways to increase your credit score

- Make quick payments: One best way to avoid a bad credit score is your consistent in paying amounts as soon as possible.

- Credit utilization: To improve the status of credit utilization, you have to make a large payment on your credit card, which will enable boosting your credit utilization. Your credit utilization should be below the 30% ratio, as anything more than that can affect your credit score.

- Check your credit reports for errors: Fixing credit reports for errors is the most critical stage. You have the right to record a good credit report as it focuses on surface errors such as incorrect items. Address every mistake, no matter how big or small.

Minimum credit score to buy a car: the bottom line

By now, you must have been clear that you can still secure auto loans with bad credit. All it takes for you is to apply for loans, and there you have your experience behind the wheel.