How To Build a P2P Lending Platform

Statista specialists prognosticate the price of the global peer-to-peer lending market will approach to $ 1,000 billion by 2025. This intends that crowdfunding corporations are going to take a bigger slice of the pie right in front of authorities.

Along with the famous Lending Club, Funding Circle, and Upstart, there are different members winning recesses such as actual property, cryptocurrency, and ICOs, automotive banking, establishment marketing, teaching, etc.

While some may dispute P2P lending software solutions are an exceptional subject to jump inside, peer-to-peer loans shall remain to fight including common banking outcomes quickly.

Till then, let’s consult why you should produce a P2P lending platform, what emphasizes it should have, and what resources to place for producing a P2P lending platform.

Actions to Organize a P2P Lending Platform

Before you begin composing a P2P lending platform, make certain you are common with the administrative demands for digital lending in your country.

Remarkable nations need permission, while others do not. The earlier you begin your legal prep work, the quicker you can get your P2P lending business to market.

Earlier, we looked at the rules in some countries so that you can see at a look:

- United Kingdom;

- Saudi Arabia;

- Africa;

- Spain.

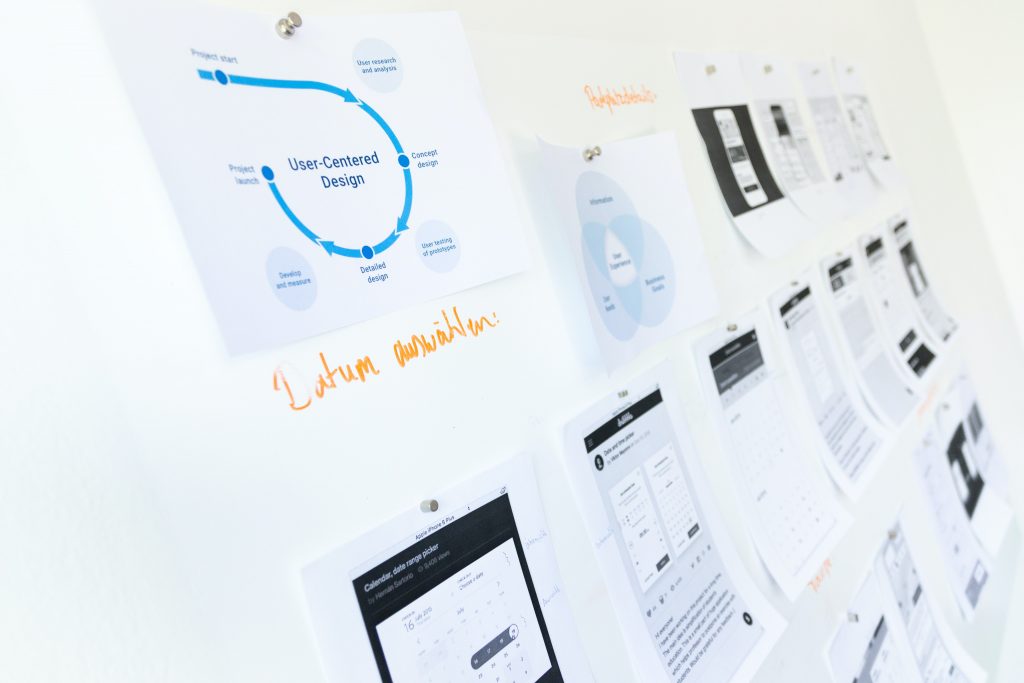

Presently we shall examine some of the scientific and technological features of creating a P2P lending platform. You may create your P2P lending platform with your sources, or manage the technology expertise of a software improvement associate. Considering you are viewing for a development ally, you should require the following actions:

- close connection with the businesses manager and business examiner;

- the form of plan opportunity and production of technical documentation;

- allowing a collaboration type such as a dedicated crew, a set price, or time and supplies;

- full-cycle development or production of a distinct purpose depending on the project and designations;

- review, fault correction, and support;

- help plus resources or extra development.

Corporations normally use company examiners to manage each project’s specifications and guarantee that the outcome is in order with the market. Based on this data, we will provide some reports that will work as a roadmap for the development of a P2P lending platform:

- term of conditions;

- goods form and specifications.

This will benefit us to wait on track and create the product as needed and within our proposed resources. The entire workflow is regularly based on a scrum methodology that helps to perform duties in races and is an effective collaborative atmosphere. Upon conclusion of the scheme, accurate conclusions can be required:

- you suit the purchaser of the goods, its source key, documentation, and additional assets as defined in the contract;

- in the state of custom software development, you may be suited for a license for resolutions or techniques incurred in the manner.

While the task is finished, all extra specialties that were not added in the scheme evaluation documentation will be carried individually and the extension method will be repeated. Typically, the expense of developing a professional P2P lending platform begins at $ 75,000 and includes:

- customized plan arrangements created for a special recess of the P2P lending platform;

- dynamic cash processing method;

- comfortable administration way for purchasing and SEO goals;

- automated KYC / AML checks;

- investing in debt and investment tools;

- private purchase and pay flow that equals your habits of business requirement;

- report authority systems, research, filtering, etc.

Crowdfunding and P2P Lending Software

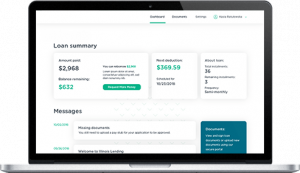

You can decrease the expense of forming a P2P lending platform and stimulate its launch with off-the-shelf software. Various choices on the market vary in complexity, maintenance, customization, and cost.

Most of them can be quickly combined via API and personalized according to the requirements of the site owners. We have formed our crowdfunding software named LenderKit, which targets online crowdfunding portals based on funds, benefactions, outsourced IT, and P2P investments.

This is perfect if you plan to begin with an MVP and then upgrade to an advanced version of your platform. An MVP built with LenderKit will take you $ 35,000 or more, depending on the quantity of customization needed.