Top New Scams For 2022 And How They Can Affect You And Your Business

The Covid pandemic has created a whole new window of opportunity for unscrupulous scammers trying to get their hands on your personal details and hard-earned money. From phishing emails to cold calls, scammers are finding increasingly sophisticated ways to target victims. Here we outline some of the latest scams and how you can protect yourself and your business.

Delivery scams

The pandemic resulted in a huge increase in online shopping, and this has given rise to delivery scams. Texts or emails purporting to be from Royal Mail asking for payment for a package to be delivered. Emails stating that a package could not be delivered as no one was in, with a link to a form to fill in your details. These are common delivery scams. Royal Mail will never collect money by text, if there is money owed they will post a card through your door.

Fake refunds

Many of us have had to cancel holidays due to the pandemic and this has given rise to cold callers purporting to be from airlines or travel agents asking for bank details to process the refund. Some are even managing to use numbers that make it look like they are calling from the real company. Don’t be fooled, a genuine company will never phone and ask for your bank details.

Charging for travel forms

Most countries still require you to fill in a passenger locator form. These are free and accessed from an official government website. Beware of fake websites trying to charge for these forms, some look very legitimate, you will never be charged to fill in a passenger locator form.

Bank scams

These have been around for some time but continue to be popular ways of defrauding unsuspecting victims. Someone phones claiming to be from the bank to say that there is suspicious activity on your account and that you need to move your money to a new account.

Some even fool people by urging them to hang up and call their bank, but then stay on the line playing a recording of a dial tone. If you can, use a different phone to call your bank back. Other bank scams include sending a text to say a new payee has been set up with a fraudulent link to click on to verify/cancel them.

HMRC scams

These are now so widespread that the UK Government have published a list of their current messages so that you can recognize genuine contact. Popular scams include a cold call supposedly from the HMRC saying that you are being charged with tax fraud; an automated message saying that HMRC is filing a lawsuit against you; a cold caller saying that you owe £500 in unpaid tax and will be arrested in a few hours if you don’t pay; and a message via social media offering help with a rebate for £500. HMRC have stated that they will never text, email, or phone asking for bank details or pin numbers.

Fake travel companies

Be careful when booking flights or holidays. Scammers have been known to set up flight or holiday booking websites that look genuine but are rogue. People only find out that they have been scammed when they turn up at the airport to find they can’t check-in or at a hotel and there is no reservation.

Make sure the company you book with is a member of ABTA or ATOL by checking their websites. Google the company too, if it is fake there will be complaints on the internet.

New Scams For 2022: Council tax scams

People have received phone calls, texts, and emails supposedly offering them a council tax rebate, they are then asked for their bank and personal details to process the rebate. The council will never ask for your bank details by phone, email, or text, they will always write to you.

Scams targeting businesses

It is important to train all your staff on detecting and avoiding scams – scammers will often target junior staff. Businesses like exhibition stand contractor Quadrant2Design do just this, MD Alan Jenkins said ‘We run training courses for all the staff regularly on how to detect scams. But they are clever, and the odd thing does slip through the net. It’s important to keep up to date with the latest techniques.’

Publishing and advertising

The most common business scam is the issuing of rogue invoices that purportedly come from often commonly known publications relating to advertising space. A cold caller may state that someone else has authorized the order.

Data protection

A recent scam is letters being sent demanding £95 + VAT to provide data protection registration for your business. The letters look official and threaten legal action. However, the current fee for this is £35 with no VAT.

Business rates

Fake consultants claim to be able to reduce your business rates for a fee, but this never happens.

Computer viruses

A caller, supposedly from Microsoft or a related business, claims to have found a virus in your computer network. They will offer to clean it up for a fee. This is a scam, you should have good anti-virus software to guard against this.

Office equipment

Scammers phone and state that office supplies have been ordered and they just need a signature. You are then sent and invoiced for often overpriced supplies.

Tips to avoid scams

- Never click on links in unsolicited texts or emails, no matter how genuine they look.

- Check the domain name of the email sender to see if it looks genuine.

- You can also use reverse email lockup services in case you need to check the email immediately and much more detailed.

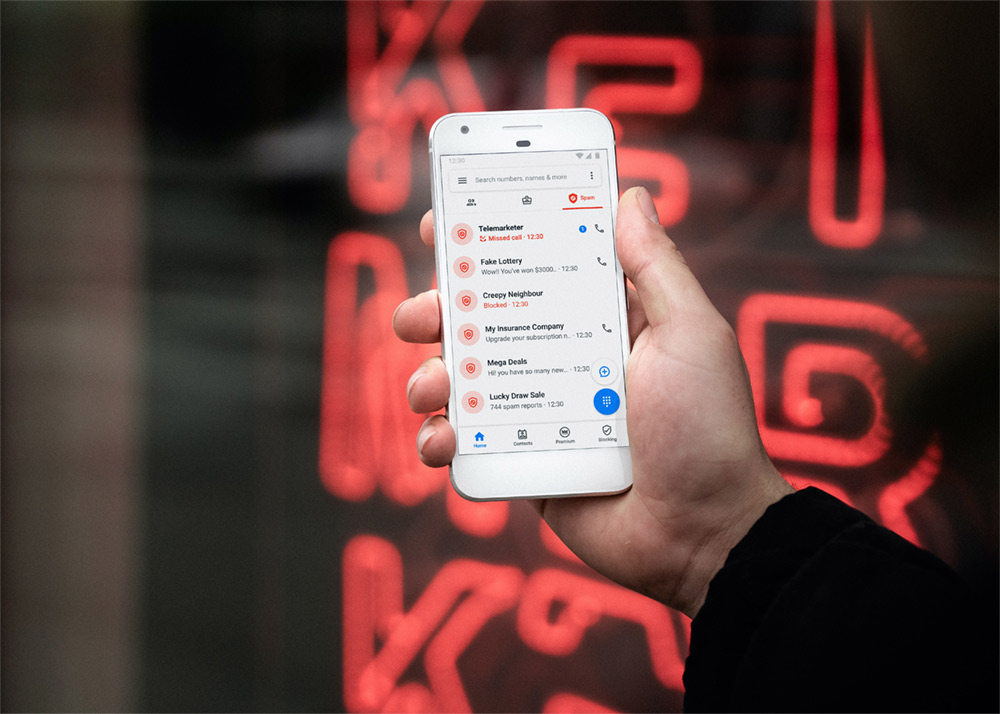

- Be wary of answering phone calls from numbers you don’t recognize, if they are genuine they will leave a message.

- Brief your staff – scammers will often target junior employees.

- Check invoice payee details against a genuine invoice to see if it is real.

- If you don’t recognize the name of a company, type it into Google, if it is a scam there will be warnings and complaints.

- If in doubt check for the company registration on Companies House.

- Check the Action Fraud They have an A-Z list of frauds.

- Register with the mailing and telephone preference services to cut down on unsolicited calls and posts.

- Legitimate texts usually come from a named source, spam texts tend to be from a random number asking for a reply – don’t reply.

- Pay by credit card for added protection, never transfer money to someone you don’t know.

- If paying on a website make sure it is secure, the web address should start with ‘HTTPS’ rather than ‘HTTP’ and there should be a padlock, usually before the name in the search bar.

- Watch out for companies that address you as ‘Dear Sir/Madam’, the real companies will know your name and use it.

- Shred sensitive documents.

- Beware of urgent deadlines, nothing is that urgent even if your account is being hacked. If you are pushed to meet a deadline there is probably something else going on.

- Reputable search engines aren’t a guarantee of reputable websites.

- Be wary if asked to pay a fee to access a prize or loan.

- Spelling and grammar mistakes are often a sign that something isn’t legitimate.

- If you have a suspicious call from your bank, hang up and dial 159. This will connect you securely to your bank and will be able to tell you if the call was genuine.

- Your bank will never ask for your personal details by text or email.

- Always remember – if it sounds too good to be true, it probably is.

New Scams for 2022: Conclusion

Scams can set you or your business back a lot of money if you’re not careful. Scammers are becoming increasingly savvy, with genuine-looking websites, emails, and texts. Keep up to date with the latest techniques by checking the Action Fraud website. If you think you have been a victim of a scam, contact your bank immediately and report the fraud to the company they were impersonating and Action Fraud.