How Technology Helped Investors in the Stock Trading World

The internet in the 1990s had an enormous impact on investors’ lives and continued to develop as technology advanced into the 21st century. Electronic trading increases the productivity of the stock market and efficiency in trading processes.

Today, investors use high-speed computers to make purchases and sell securities in a matter of a second. Day traders rely on technologies, including analytical software and accounting software, as tools to help manage their daily trades. If you wonder how much are day trading taxes you are liable to pay at the end of the tax year, an accounting application will track your liabilities.

What is Day Trading?

Day trading is the sale or purchase of stocks daily with regular and frequent trading activities within the same day. To qualify as a day trader, SEC requires the investor to maintain a minimum equity account of $25,000. Other factors that determine if an investor qualifies as a day trader include the following:

- Length of time an investor holds on to the securities;

- Amount of cash spent on trades;

- Number of trades placed per year;

- Amount of time a trader spends trading each day.

How Can Traders Reduce Their Tax Obligations

- Write off business expenses, including office space, a home office, equipment costs, accounting costs, analytical software, and ancillary expense, such as loan interest;

- Use mark-to-market accounting, known as a tax filing selection, to report yearly profits and losses on trades. Net losses reduce income, and net gains are taxable income.

Average investors have to be careful when they sell a stock at a loss and then repurchase the same stock within 30 days of the sale date. Awash sale is when an investor harvests losses purposely to lower his or her tax liability. The wash sale rule does not apply to day traders.

Before the internet, investors and day traders had no other choice but to dedicate much of their time making trading transactions on floors or by phone. Advanced technology changed how much time an investor uses to complete a trade transaction, increasing the number of trades daily for the day trader who earns income from trading. Technology companies are transforming the world, including cryptocurrency technology, for example.

Ways Technology Influences Stock Trading

When algorithms entered the markets, it affected stock trading and lightened investors’ burden or their analysts calculating chart patterns. Computer programs do the calculations, and the algorithms determine the pricing, timing, quantity, and order routing. An algorithm monitors the market conditions of various securities, stock exchanges, and trading venues. Two ways technology affects stock trading are as the following;

- Electronic trading entered the stock market slowly in the 1980s. Nasdaq is the first electronic stock exchange. Online electronic trading sites are prevalent in 2021, with free commission fees on specific stocks;

- Online newspapers, such as the Wall Street Journal (WSJ) and other news publishers, influence the stock market. Most electronic trading sites have a menu featuring the latest news about public traded companies and businesses listed on the over-the-counter markets. Investors can learn about a company’s financial position, recent developments, and M & A (merger and acquisition), enabling them to make better decisions.

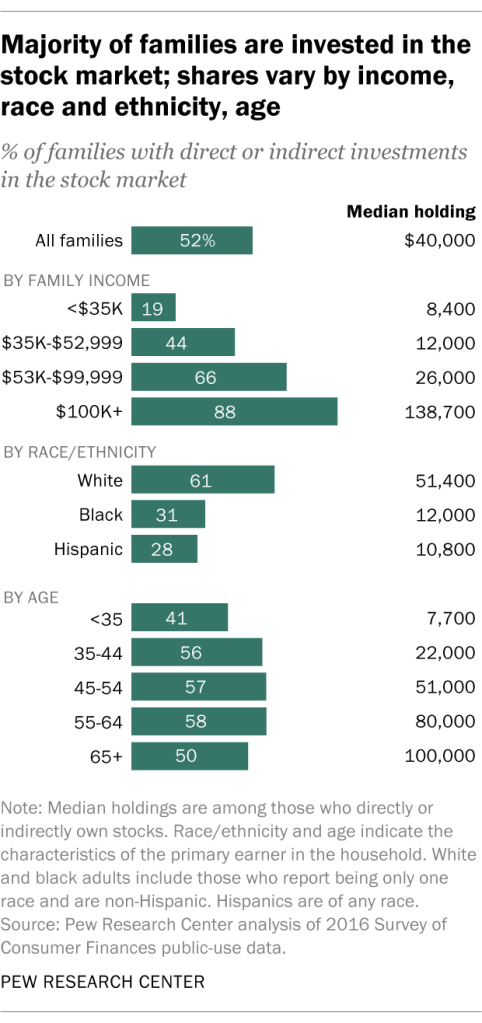

New technologies that are transforming the stock trading world comprise software, including algorithms, hardware, or the combination of both. Since the 2020 COVID-19 pandemic, more people, especially millennials, are investing in the stock markets. A Pew Research report showed that over half of households in the United States invested in the stock market in March 2020.

The first stimulus package appears to be why the increase in investors has some investment in the market. It was during a time when the stock prices fell dramatically, and the prices were meager. New millennials began trading on Robinhood, TD Ameritrade, E-Trade, Webull, and another electronic trading, no-commission fee websites.

As technology continues to advance, the stock market world will transition to bring more efficiency and increased productivity to enhance traders’ experience. Electronic trading is the new trend that allows day traders to trade online from the convenience of their home or the workplace. Accounting application technologies make it possible for an investor or day trader to track tax liabilities.