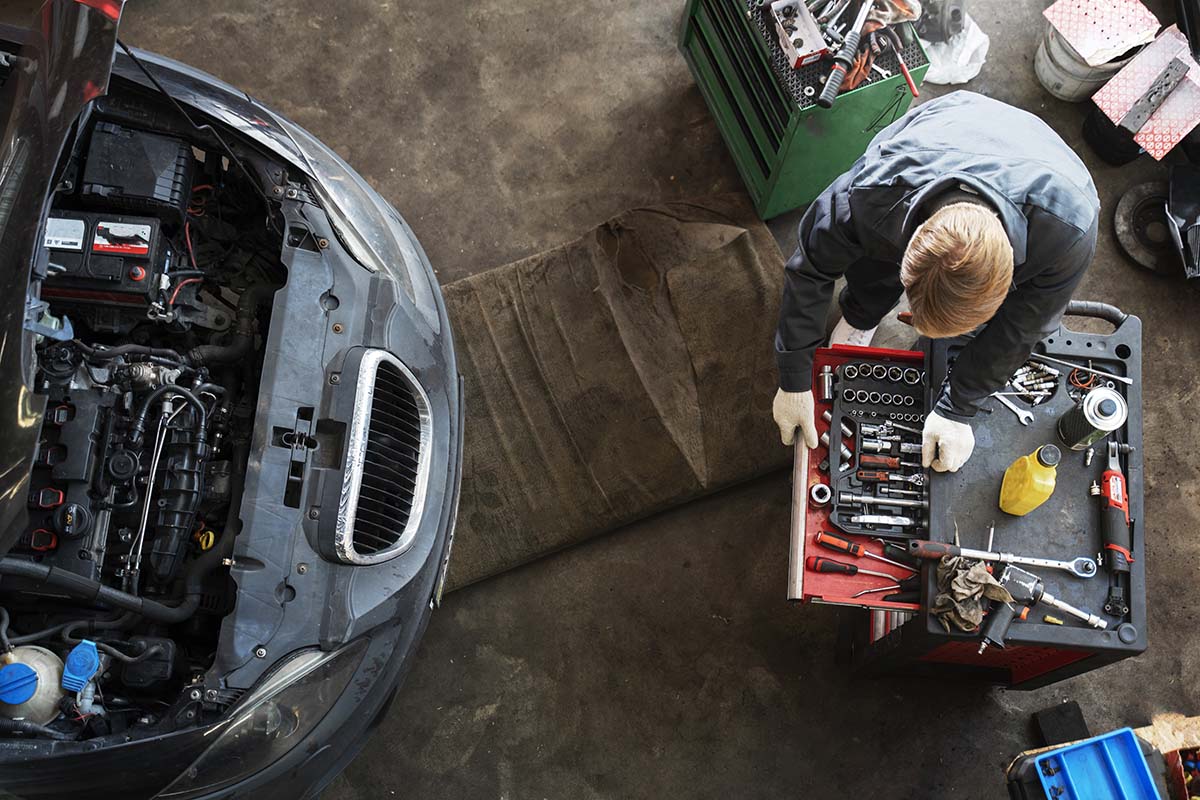

While most people don’t budget for car repairs, it’s still a good idea to set up an emergency savings account that would cover the costs of car-related problems shortly. But what do you do when you need your car fixed but have no money or don’t have enough in a savings account to cover you when the car breaks down? Here are some options for repairing your car when you can’t actually afford it.

When You Can’t Afford a Car Repair Bill: Building an Emergency Fund for Car Repairs

Before we explore alternative options, let’s emphasize the importance of building an emergency fund. Life is unpredictable, and unexpected expenses, such as car repairs, can catch us off guard. Having a dedicated savings account specifically for emergencies can help alleviate financial stress, such as the need for getting out of debt, when these situations arise.

If you haven’t started an emergency fund yet, consider prioritizing it. Set aside a small portion of your monthly income until you have enough to cover a few months’ expenses. This way, you’ll have a safety net to fall back on when faced with unexpected car repairs or other unforeseen circumstances.

Exploring Alternative Options

- Seek Affordable Repair Shops: Research local repair shops offering competitive prices. Compare their rates and read reviews to ensure they provide quality service. Some shops may even offer payment plans or discounts for certain repairs, so it’s worth asking about any available options.

- Get a Second Opinion: If you receive a high repair estimate from one shop, consider getting a second opinion. Another mechanic may offer a more affordable solution or suggest a different fixing approach. Don’t hesitate to shop around and gather multiple quotes to find the best deal.

- DIY Repairs: Depending on your level of expertise and the complexity of the repair, you may be able to tackle certain car issues on your own. Numerous online resources, tutorials, and forums can guide you through DIY repairs. However, exercise caution and be honest with yourself about your abilities. Attempting complex repairs without proper knowledge and experience can cause more harm than good.

- Barter or Trade Services: If you possess skills or services that could be valuable to a mechanic or repair shop, consider offering a trade. For example, if you’re a graphic designer, you could offer to create promotional materials for the repair shop in exchange for discounted or even free repairs. Bartering can be a mutually beneficial arrangement, helping both parties save money.

- Seek Financial Assistance: In times of financial hardship, there are organizations and programs that may be able to assist with car repairs. Non-profit organizations, community outreach programs, or religious institutions might have resources to help needy individuals. Explore these options and reach out for support.

- Personal Loans or Credit Cards: While not always the ideal solution, personal loans or credit cards can provide temporary relief when faced with urgent car repairs. It’s important to approach these options cautiously and consider the interest rates and repayment terms. Only take on debt that you can realistically manage and pay off within a reasonable timeframe.

Remember, getting out of debt should always be a priority. Before considering loans or credit cards, evaluate your financial situation carefully and determine if there are alternative ways to cover the repair costs.

Planning for the Future

When you cannot afford a car repair bill, it’s essential to explore various options and choose the one that best suits your circumstances. Remember to prioritize building an emergency fund for future expenses, including car repairs. By setting aside a small portion of your income regularly, you can gradually create a financial safety net to help you weather unexpected situations.

In conclusion, while car repairs can be a significant financial burden, alternative options are available when you can’t afford the bill. From seeking affordable repair shops to exploring DIY repairs and potential bartering opportunities, there are ways to address the issue without breaking the bank. However, it’s crucial to prioritize getting out of debt and establishing an emergency fund to prepare for future car-related expenses. By taking proactive steps and exploring different avenues, you can navigate the challenges of car repairs even when you’re facing financial constraints.